Is Difficult!

Contact Us through

Viber

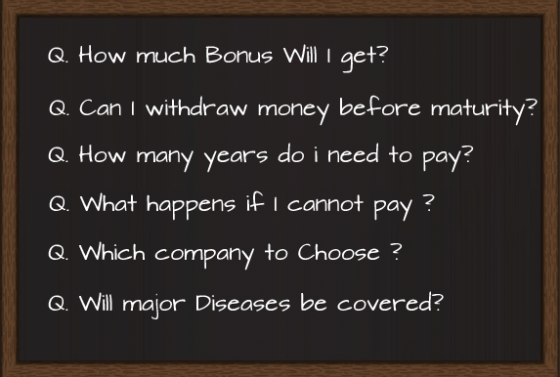

Which Insurance Company? Which Plan?

There is no Insurance plan that is “ one plan fits all ”. Every person is different, and may fit into different plans from different Insurance companies based on your requirement.

What are you Looking For ?

High Returns Plans

Life Insurance Plans

Health Insurance Plans

Child Insurance Plans

Vehicle Insurance Plans

Travel Insurance Plans

Error: Contact form not found.

– Smita Pokharel

Read more about our Terms and Conditions here.

Why Life Insurance Nepal?

Always there for our users

Whether is it is before, during or after you are insured, we try our best to provide writeups for each category of users. We are thankful of the positive feedbacks on our content on Insurance related to Nepal and will look to carry on our efforts.

Unbiased Consulting

Since we are not associated with Insurers nor are we agents or sub agents, we always look to provide unbiased and fair content in the website.

Personalized for You

You are different. So your insurance also needs to be different. We listen to you, and we try our best to provide you with the content to help you understand best option for yourself

100% Free

We believe in providing value. We want to offer professinal content so that you can recommend to anyone who needs a life insurance in Nepal.

Can’t find what you’re looking for? Try selecting a category below.

Categories :

Insurance Companies roles and responsibilities

7 Myth About Life Insurance

Health Insurance and Life Insurance

Would you like to ask us any questions you might have?

Free WhatsApp chat Consult